Debt Obligation Transparency Commitment

The City of Corpus Christi is committed to financial transparency and accountability. Through its “Transparency Star” program, the Texas Comptroller of Public Accounts recognizes local governments across Texas for going above and beyond in their transparency efforts. This is accomplished by providing citizens with clear and meaningful financial information not only by posting financial documents, but also through summaries, visualizations, downloadable data, and other relevant information.

The City of Corpus Christi is dedicated to increasing our financial transparency in regards to Debt Obligations.

City of Corpus Christi Debt Information

The City of Corpus Christi issues a variety of long-term debt instruments in order to acquire and/or construct major capital facilities and equipment for governmental and business-type activities. These instruments include general obligation bonds, certificates of obligation, tax notes payable, revenues bonds and notes, financed purchases and leases.

General Obligation Bonds

General Obligation Bonds are direct obligations with the City’s full faith and credit pledged toward the payment of these obligations and are issued upon approval by the public via an election to finance projects with benefits that accrue to the entire community. Debt service payments are primarily paid from ad valorem (property) taxes.

Certificates of Obligation

Certificates of Obligation are generally secured by a combination of ad valorem taxes and revenues from a source that the City is authorized by State law to encumber for a public purpose. Voter approval is not required; however, additional notification and public hearing requirements may apply.

Tax Notes

Tax Notes are secured by ad valorem taxes and may be issued to finance construction of public works, purchase of equipment, materials, buildings or land, and to pay for certain professional services. State law limits the term to a maximum of seven years.

Revenue Bonds and Notes

Revenue Bonds and Notes are payable from the pledged revenue generated by the respective activity for which the bonds or notes are issued.

Corpus Christi Business and Job Development Corporation (CCBJDC) is a blended component unit of the City. Its Sales Tax Revenue Bonds are secured by a pledge of dedicated sales taxes and financed major repairs to the Seawall System and an arena.

Combined Utility System Revenue Bonds are secured by a pledge of Utility System revenues and are used to finance acquisition and construction of equipment, improvements and infrastructure necessary to provide Water, Wastewater, Storm Water and Gas services.

Combined Utility System Revenue Notes are secured by a pledge of Utility System Revenues and were used to finance the purchase of natural gas supplies during Winter Storm Uri in February 2021.

Marina System Revenue Bonds are secured by Marina System revenues and are used to finance improvements to the City Marina.

Finance Purchase Agreements

Finance Purchase Agreements are used to finance the purchase of capital equipment. The Financer retains a security interest in the property until termination of the lease.

Leases

Leases are noncancellable agreements providing the City the right to use property and equipment. The Lessor maintains ownership of the assets while the City has the right to use the assets during the term of the lease.

__________

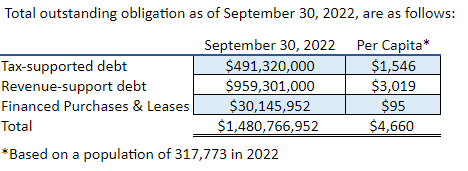

Total Outstanding Debt Obligations as of September 30, 2023

City of Corpus Christi: Inflation-Adjusted Tax-Supported Debt Per Capita, Fiscal 2019-2023 (2023 Dollars)

City of Corpus Christi: Tax-Supported and Revenue-Supported Debt, Fiscal 2019-2023 (in Millions)

Additional Debt Information

Adopted Budget Debt Information

Additional Financial Documents

Texas agency that ensures debt financing is used prudently to meet Texas' infrastructure needs and other public purposes, supports and enhances the debt issuance and debt management functions of state and local entities, and administers the state's private activity bond allocation.

Texas Comptroller Debt at a Glance

The Texas Comptroller's office provides debt statistics on all Texas cities, counties, school districts, and community college districts, as well as the State of Texas.

The Jurisdiction Tax Rate for the City of Corpus Christi.

The Jurisdiction Tax Rate for Nueces County.